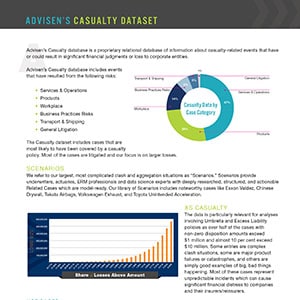

Advisen’s Casualty loss data is a proprietary relational database of information about casualty-related events that have or could result in significant financial judgments or loss to corporate entities. Our Casualty data includes litigated cases that are most likely to have been covered by a casualty policy.