Brokers say it’s still a buyer’s market in D&O.

Capacity for directors and officers liability insurance is plentiful, and primary placements for public companies “should see stable pricing in 2015,” according to Willis’ Marketplace Realities report.

The premiums account for 20-28 percent of the broker’s D&O business, which in turn makes up at least 60 percent of management liability lines—excluding standalone cyber cover.

One caveat is the performance of financial markets and the economy.

“Shareholders are making money now,” said Deneen Schmitt, executive vice president and risk specialist at Willis. This is taking the steam out of securities class actions against corporate directors and officers. A major stock-price correction could change that, Schmitt said.

Another thing buyers have going for them is the 2014 Supreme Court decision in Halliburton Co. v. Erica P. John Fund Inc., which allows companies to preempt class certification in securities suits if they can demonstrate their actions didn’t hurt share prices. The suits are one of the biggest and costliest risks faced by directors and officers, and a primary reason for seeking coverage.

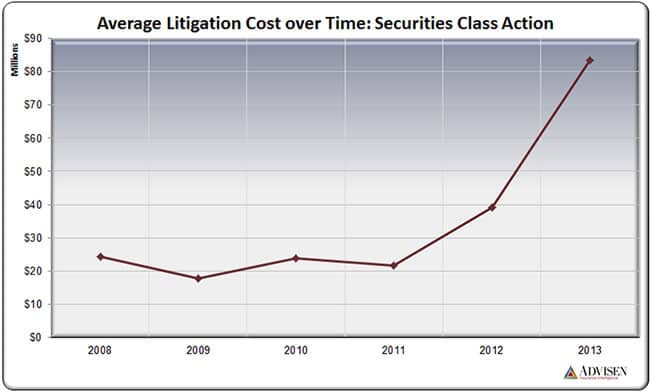

Advisen’s Loss Insight database shows that, in the five years ended in 2013, the average cost of litigating securities class actions more than quadrupled, to about $83.3 million.

The Halliburton decision “hasn’t played itself out yet, but it opens an avenue” for blocking class certification, Schmitt told Advisen. Some carriers, including AIG, added endorsements to their policies to cover the cost of “event studies,” which are required to demonstrate a lack of price impact in the cases.

An emerging risk for D&O is being sued for poor oversight or inadequate controls in connection with a cyber event, she said.

Willis forecast overall prices in 2015 to range anywhere from a 5 percent decrease to an increase of the same amount. Excess layers could fall as much as 10 percent, including for Side-A coverage of individual directors and officers.

Private companies could see price jumps of as much as 10 percent, with financial services seeing increases of up to 3 percent. Nonprofits should expect flat to 10 percent gains; life sciences, 5-10 percent more, and health care, a jump of 10-15 percent, the broker said.

Brenda Shelly, D&O product leader at Marsh, expects rates to keep falling “from their 2011, 2012 highs.”

Clients with a clean risk profile could see anywhere from a 3 percent decrease to a 2 percent increase in premium prices, she said. Excess layers, meanwhile, are more competitive.

“There is already a lot of capital in the markets,” Shelly said. “Without consolidation, it affects prices.”

And, while Halliburton may provide relief to companies, “plaintiffs’ attorneys are likely to get creative” and find other approaches, including through independent derivative actions, especially in the case of cyber events, she said.

Brian Wanat, CEO of Aon’s Financial Services Group, agrees.

“Plaintiffs attorneys are just too crafty,” he told Advisen. “As soon as there’s a roadblock, they come up with something else.”

He also sees continued softening in public company primary D&O placements, which will be “lucky to go flat in 2015.” Supply in excess layers has made that market a negative for carriers.

Wanat also said demand for cyber coverage has gone “through the roof” in the broker’s errors and omissions lines—aimed at professional and financial services firms—but hasn’t yet become a significant factor for D&O.

Cyber events haven’t “yet translated into massive lawsuits” against directors and officers, he said.

Shelly sees cyber risk rising to the board level, though it’s well established as an E&O risk at Marsh.

Sandy Codding, managing director in the Financial and Professional Liability Practice at the broker, said cyber coverage is blended into policies for technology and media companies to produce greater “efficiencies” for buyers and reduce the risk of gaps in coverage.

Growth in pricing for both tech and media could accelerate to as much as 5 percent in 2015, the broker said, even as other industries remain relatively flat. Tech companies saw increases of up to 3 percent in 2014, while those in media had anywhere from a decrease of 3 percent to an increase of 2.5 percent.

Arthur J. Gallagher predicts flat D&O renewals for public companies in 2015. Rates for some excess layers could fall 2 -3 percent because of stiffer competition in that market.

New entrants have been drawn by the fact that “it’s easier to get forms filed, and the absolute level of the premium is bigger” than for other lines, said Phil Norton, vice chairman of the Midwest region at the broker.

Private companies could see premium increases of 5 percent, he told Advisen.

Marsh’s Shelly thinks rates for private companies could jump as much as 15-20 percent in 2015, as these entities continue to catch up with their public counterparts.

Private companies rarely bought D&O coverage but have begun to see threats similar to those faced by public companies, including shareholder lawsuits, Shelly said.

Another risk for directors and officers will be claims on initial public offerings—which have picked up–particularly because the cases are easier to bring than for securities actions.

“All that said, it’s still a buyers’ market,” Shelly added.