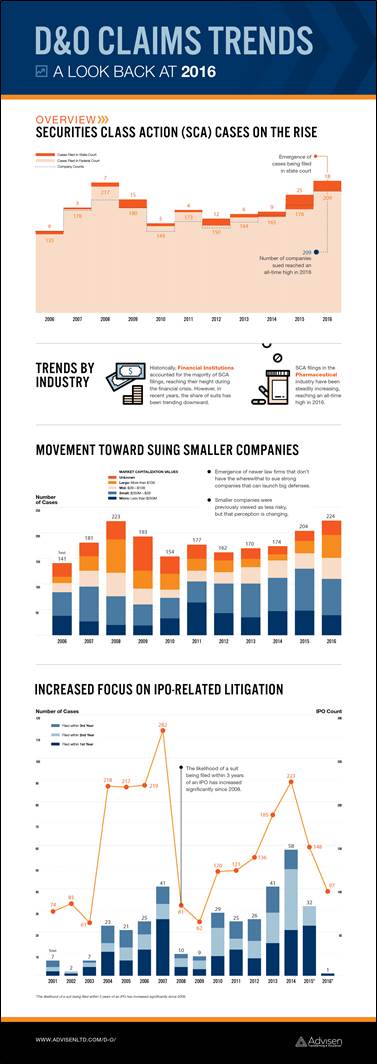

Number of companies sued reached an all-time high in 2016

NEW YORK, April 7, 2017 –Advisen, the leading provider of data, media, and technology solutions for the commercial property and casualty insurance market, shared a number of 2016 year-end D&O claims trends derived from the company’s proprietary database of more than 400,000 cases, events, and actions.

NEW YORK, April 7, 2017 –Advisen, the leading provider of data, media, and technology solutions for the commercial property and casualty insurance market, shared a number of 2016 year-end D&O claims trends derived from the company’s proprietary database of more than 400,000 cases, events, and actions.

Securities Class Action (SCA) cases are on the rise, with the number of companies sued reaching an all-time high in 2016. Courts are seeing an emergence of SCA cases being filed at the state level.

Historically, Financial Institutions accounted for the majority of SCA filings, reaching their height during the financial crisis. However, in recent years, the share of suits being filed against Financial Institutions has trended downward. In contrast, SCA filings against the Pharmaceutical industry are on a steady rise, reaching an all-time high in 2016.

The data shows a movement toward suing smaller companies (particularly those with market caps under $2 billion), partly driven by the emergence of newer law firms that don’t have the resources to sue strong companies that can launch big defenses. While smaller companies have typically been viewed as less risky, that perception is now changing.

SCA filings since 2008 have demonstrated an increased focus on IPO-related litigation. The number of suits being filed within 3 years of an IPO increased significantly as the count of public offerings took off.

“The D&O claims trends data highlights the continued evolution in the landscape of litigation against public companies. Advisen’s loss data allows professionals to monitor trends and develop strategies to operate effectively in this environment,” said Jim Blinn, Executive Vice President of Client Solutions at Advisen.

Advisen’s public D&O database includes nearly 20,000 cases relating to directors and officers liability affecting public companies that have or could result in significant financial judgments or loss to directors, officers, and corporate entities. Learn more by requesting a public D&O demo.

Media Contact:

Charlene Farside

Advisen

+1 (302) 861-6917

[email protected]