Law firms face increasing severity of Lawyers Professional Liability claims as well as a rising frequency of cyberattacks, according to EPIC and Advisen data.

Several factors have contributed to the rising severity of Lawyers Professional Liability (LPL) claims, including an influx of large law firm litigators, quicker resolutions of claims with questionable defenses to liability allegations, and generally higher settlement demands and indemnity payments, said EPIC, a brokerage and consulting firm.

Increasing defense costs for LPL claims was also cited by underwriters as a contributing factor to the increased severity of losses, according to the report.

LPL losses in Advisen’s database stem from alleged breaches of fiduciary duty, alleged failures to negotiate terms, and alleged failures to sue the correct defendant, among others.

Drafting errors, failure to supervise young associates, failure to properly counsel clients on the risks of trial, errors in calculating deadlines and technology-related errors – like court notices or payment notices blocked by spam filters – were additional claim sources noted by EPIC.

Additionally, there are variations in the frequency and severity of LPL claims by state, according to Advisen data.

Delaware, Arizona, Utah, Kentucky, Montana and Wisconsin had the highest average cost of loss associated with LPL claims. New York, California, Texas and Illinois had the greatest frequency of LPL claims in the United States.

Exhibit 1: Average cost of LPL claims by state

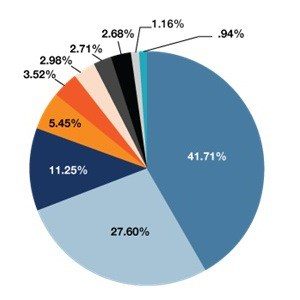

Cyber is also a growing concern for law firms – accounting for 54% of non-LPL losses – a number which has grown dramatically in recent years, according to Advisen loss data.

From 2006 to 2016, the number of cyber losses faced by law firms increased 300%, with $13 million in total loss value recorded in 2016 alone, according to Advisen data.

Exhibit 2: Cyber Losses in Law Firms by Accident Date

Employment Liability and Directors & Officers Liability (D&O) also account for a large percentage of losses in Law Firms – 18% and 6% of non-LPL losses, respectively.

Exhibit 3: Non-LPL Losses in Law Firms by Frequency

Data Journalist Rebecca Gainsburg can be reached at [email protected].

To learn more about Advisen’s data call (212) 897-4800 or email [email protected].

*Advisen’s loss data is curated from a wide variety of public sources. Our collection efforts focus on larger and more significant cases. For this reason, the figures in this article may not be fully representative of all cases of this type.