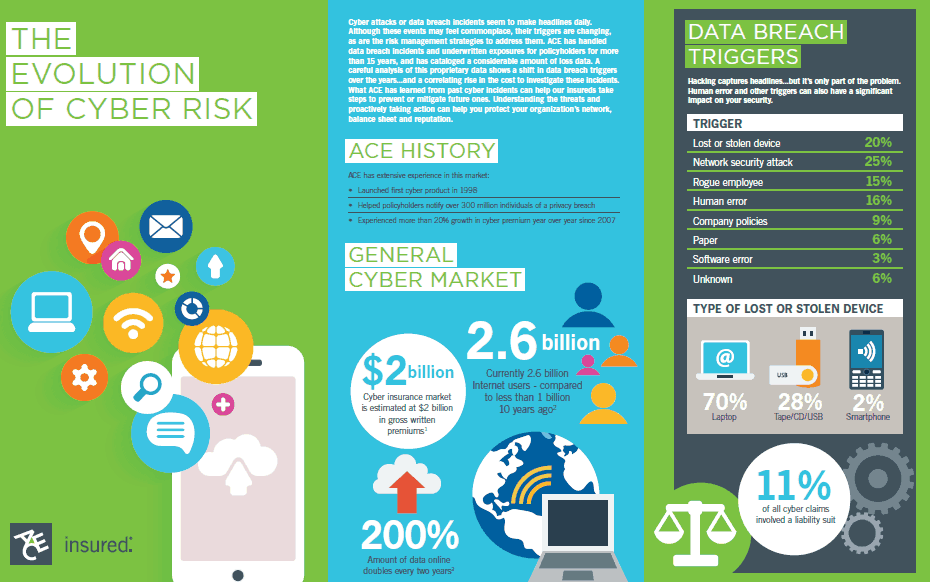

ACE Group has opened up 15 years of cyber claims data to enable clients to focus their attention and develop risk management strategies to address evolving triggers.

Matt Prevost, vice president of ACE Professional Risk, told Advisen at the RIMS Annual Convention in New Orleans that the information gleaned from its claims history can lead to specific recommendations based on the insured’s industry.

“As an industry, we have not done a good job differentiating between industry verticals,” he said. “We took a deep dive into our claims data to find out what we consider to be problematic and identify cyber controls that have an impact on risk and loss. The data we have is credible and very valuable.”

For instance, according to an infographic from ACE, cyber claims from lost or stolen devices were down more than 20 percent from 41 percent in 2008. Why? Encrypting technology on mobile devices clearly reduced the risk.

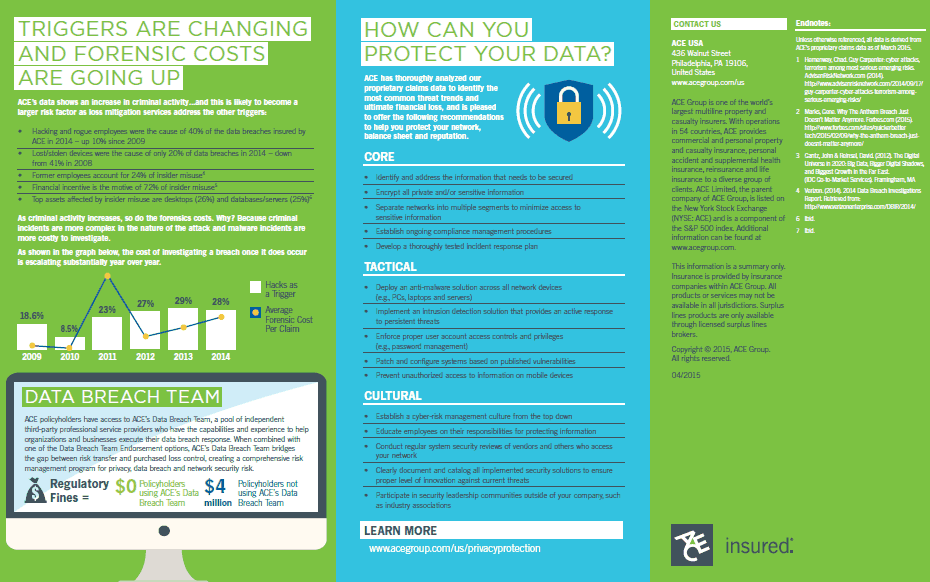

Other highlights: ACE found 40 percent of breaches insured by the company were caused by rogue employees. Forensic costs are also on the rise because cybercriminals are using complex techniques and malware is costly to investigate. Eleven percent of claims involve a liability lawsuit.

Importantly, ACE has begun to quantify the affect of its data breach team. Policyholders who use it see no regulatory fines. Those without the services have suffered $4 million in fines.

Click the infographic to see larger images and find out ACE’s experience regarding data breach triggers and find out its recommendations for companies.